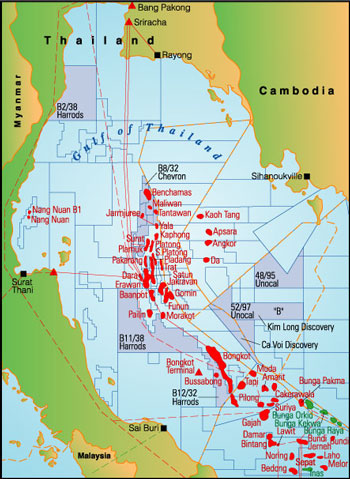

Gulf of Thailand now enjoying renewed activity

By Phil Dickson, Singapore

Contents

Chevron B8/32

Harrods Energy

Unocal

Bongkot Unit

Blocks 14A-15A-16A

MTJDA

Malaysia, PM-3

Vietnam

In December 1999, we wrote that established producers and new entrants had good reasons to allocate funds to exploration and appraisal programs in the Gulf of Thailand. Among these reasons, the postponement of ambitious gas import projects in the aftermath of the economic crisis meant that any additional gas reserves would gain access to the domestic market in the mid-term, earlier than previously planned and in spite of the current situation of oversupply capacity.

Not only has that approach been successful, some distinct oil reserves have also been evidenced during these campaigns and exploration, appraisal, and development activity will be sustained for years to come.

Highlights since the December review can be summarized from north to south of the area with emphasis on individual companies and their plans for the future.

Chevron B8/32(Return to Contents)

Chevron has consolidated its role of operator acquired in 1999 without reporting any significant addition to reserves. Production is ongoing from Tantawan (85 million cf/d of gas and 9,000 b/d of liquids) and from Benchamas (75 million cf/d and 8,000 b/d of liquids).

Maliwan-7, an appraisal well was reported P&A dry, and Kung-2, an exploration well, had oil shows. Maliwan and Jarmjuree, Fields with gas and liquids, remain candidates for future developments with studies underway.

Harrods Energy(Return to Contents)

Harrods has followed a two-pronged approach to develop its upstream business in Thailand: carry out exploration and appraisal on the acreage it operates, and increase its participation in such acreage while acquiring more exploration acreage. Appraisal works were aimed at proving the commerciality of the oil and gas discovery at well B5/27-3. Three wells, B5/27-6, B5/27-7, B5/27-8, and four sidetracks (6B, 6C, 6D, 7B) have been drilled with oil shows and oil and gas bearing intervals in most, with well B5/27-8 reported dry. Harrods is investigating the possibility to develop the 20 to 30 million bbl liquid reserves.

The exploration well Chang Puah-2 on Block B11/38 was reported dry.

Harrods has increased its acreage position by acquiring interest from its associates in some of the concessions. Harrods took over the interest of Texaco in B12/32 and in B11/38 as Texaco was withdrawing from upstream activity in Thailand prior to its merger with Chevron.

Harrods also acquired the remaining 37.5% interest of PTT-EP in B12/32 with the Bussabong discovery, adjacent to the Bongkot area, west of it. Harrods is now the sole concession holder in B5/27, B2/38 and B11/38, and has a 74.07% interest in B12/32 (Dragon Oil, 25.93%).

Harrods has relinquished B11/32.

Chevron and Harrods have submitted competing applications for G4/43, south of Harrods' B5/27 and west of Chevron's B8/32.

Unocal(Return to Contents)

As expected, Unocal has been the most active operator in the Gulf of Thailand.

Unocal has in its different contract areas, a number of discoveries lined up for appraisal and development as and when access to market becomes available. The novelty, previously mentioned, is that with increasingly sophisticated technology in both seismic and drilling, more distinct oil-bearing reservoirs are evidenced and are candidates for development notwithstanding the oversupply capacity of gas.

Unocal operates currently thirteen gas and condensate fields in the Gulf of Thailand with a production of more than 1 billion cf/d of gas and 34,000 b/d of liquids with co-venturers PTT-EP, MOECO (Mitsui Oil Exploration), and Amerada Hess, the latter for B12/27 only (Pailin Field).

The net share of Unocal is approximately 600 million cf/d and 20,000 b/d.

Production is expected to remain at the same levels for several years. The decline in production from such mature fields as Erawan is expected to be offset by the increase in production from Pailin, from its current 165 million cf/d to 330 million cf/d in 2003. Trat, like Pailin, was put in production in 1999 and produces some 70 million cf/d. Such fields as Pakarang, South Gomin, and Dara will be developed as and when demand justifies.

Two of the fields for which oil production is considered independently of gas production are Plamuk and Yala. Plamuk-3, 4 and 5 have found significant oil-bearing intervals. However, typical of the reservoir distribution in the Gulf of Thailand, Plamuk-5 has encountered 150 meters of hydrocarbon-bearing formations in 23 intervals, out of which 83 meters of oil-bearing sands in 14 zones. Yala-3, 4, 5, 6 and 7 have also found significant oil-bearing intervals with the same type of distribution, in addition to gas and condensate. It is located in B 10A/ B11A in the northern part of the area, close to Tantawan (B8/32).

Bongkot Unit (Return to Contents)

Phase IIIB of development of the Bongkot Unit (PTT-EP operator, TotalFinaElf, BG) is ongoing to maintain production levels at 550 million cf/d and 12,000 b/d.

It is worth noting that Bongkot is one of the fields where significant oil-bearing reservoirs were first evidenced in 1994-95.

Blocks 14A-15A-16A (PTT-EP, Unocal, MOECO) (Return to Contents)

The discovery at Arthit 15-1x reported in December 1999 in the area formerly disputed with Vietnam (Blocks 14A, 15A, 16A operated by PTT-EP in partnership with Unocal and MOECO) has been followed by another five wells, Arthit 15-2x to 15-6x, not mere appraisal wells but "step-out" wells along a southeast-northwest-elongated trend. These wells have evidenced reserves in a range of 3 to 6 tcf according to PTT-EP with a good condensate yield of 30-40 bbl/million cf.

MTJDA (Return to Contents)

The development by Petronas Carigali, Triton, and BP is launched as mentioned in the December 1999 review. The mandatory Environment Impact Assessment (EIA) is the occasion of unrest from several groups protesting not so much against the environmental damages that the pipeline would cause, than against the nuisance that the industrialization of South Thailand would create with plans for petrochemical plants.

Whether delays in the project could ensue is not clear as the environmentalists claim that the EIA is undertaken to no avail as the development has been decided two years ago.

Malaysia, PM-3 (Return to Contents)

Production from Bunga Kekwa (Lundin, Petronas Carigali, Petrovietnam) has been raised from 12,000 b/d to 13,500 b/d and 15,000 b/d in October 2000, the latter increase through the reperforation of two producing wells. Further works in 2001 including the drilling of two wells are expected to bring production up to17,000 b/d.

Phase II of development is on course for production from September 2003 of 250 million cf/d of gas and 40,000 b/d of oil and condensate. A gas sales agreement has been signed in spite of the distance to peninsular Malaysia to the southwest and Vietnam to the northeast, with lack of infrastructure at the landfall in Vietnam.

Vietnam (Return to Contents)

Unocal has recently announced the results of the drilling campaign on Blocks 48/95 A, B, and 52/97 this area, part of the "greater" Gulf of Thailand in its geological meaning. Four wells have confirmed the 1997 gas discovery on the Kim Long trend. The Kim Long trend appears to be gas bearing for more than 21 miles (34 km) over Blocks B and 52/97.

The successful wells drilled on the Kim Long trend so far have averaged net pay of 41 meters. Three wells in the trend have been tested: the B-KL-1X flowed 53 million cf/d from two zones, B-AQ-1X had a maximum calculated flow of 39 million cf/d from three zones, and 52/97-AQ-3X flowed 54 million cf/d from five zones. The well 52/97-CV-1X, drilled on a separate prospect (Ca Voi),16 km west of Kim Long has encountered 32 meters of net gas pay.

Unocal states that this campaign has proven 1tcf of gas, with a total potential in the range of 2-8 tcf. The co-venturers of Unocal in Blocks A and B are MOECO, PTT-EP, PetroVietnam, and Repsol, but the latter is in the process of withdrawing from the venture, with its interests to be distributed between the remaining parties. In Block 52-97, MOECO and PetroVietnam are the co-venturers and PTT-EP is expected to join soon.

The association for Blocks A and B has drafted a plan to produce gas at a rate of 200 million cf/d beginning in 2005. A gas sales agreement will have to be negotiated with the Vietnamese buyer(s).

These are still early days and we understand that this plan could be modified in order to take into account further reserves including Block 52/97, and the evolution of the supply/demand situation with several options to be envisaged.

While other areas of open acreage in Thailand, particularly onshore, do not attract a high level of interest from oils and gas companies, the ongoing build-up of gas and liquid reserves in the Gulf of Thailand bodes well of the activity in that area during the next five to ten years.

To review last year's report on the Gulf of Thailand, click here.

To comment on this subject, go to our Discussion Forum by clicking here.