India's New Liberal Licensing Policy No Help

by Mike Beanland, Perth

Contents

With its oil consumption growing rapidly, India is attempting to limit its dependence on imports by expanding domestic exploration and production. The country's Ninth Five-Year Plan states that it will run out of oil reserves by 2012, even if only 30% of demand is met by domestic production, and it emphasizes the need for new discoveries to prevent this outcome. To address this, six rounds of exploration bidding have been held since 1991, and in 1997 the government announced the liberal New Exploration Licensing Policy (NELP), an initiative which permits foreign involvement in exploration, an activity long restricted to state-owned Indian firms.

Recent exploration history does not, however, support an optimistic view, with no major new finds having been made in recent years. The government hopes that foreign investment will lead to not only more exploration and discoveries, but also the introduction of technology to improve the current low (ave.~30%) recovery rate.

In exploration terms, other than western Rajasthan, the one onshore area which has shown promise, the only other potential is offshore and in deepwater.

Deepwater Confidence(Back to Top)

Indicating its confidence in the prospectivity of the region, Western Geophysical has acquired approximately 11,000 km of non-exclusive seismic data in the deepwater area off the east coast of India, including some of the recent NELP blocks.

NELP Awards 2000(Back to Top)

The most recent block offer was in January 1999, when a total of 48 blocks, including 12 in deepwater, were put on offer. Despite an international roadshow (London, Houston, Calgary, Singapore, Perth), only 27 of the 48 blocks received bids. Neither Shell, Amoco, Chevron, BHP, or Enron, who have bid or taken up exploration blocks in the past, nor any other major multinational oil companies bid on any of these blocks.

Twenty-five blocks were approved for award in January 2000, including two onshore, seven deepwater offshore, and 16 in shallow water, (three were bids invited in earlier rounds). India's Reliance Industries in partnership with Niko Resources of Canada got the lion's share with the award of 12 blocks, including three in deepwater, while UK-based Cairn Energy received one deepwater offshore block off the east coast in the Krishna-Godavari Basin. Oil India Ltd (OIL) also received a block. Russia's Gazprom, the US firm Mosbacher Energy, and Geopetrol of France were all awarded single blocks in partnership with Indian firms.

India's state-run Oil and Natural Gas Corporation (ONGC) won eight blocks of which three lie in deeper waters, two it holds are in partnership with state-run Indian Oil Corporation (IOC) and one with Gas Authority of India Ltd (GAIL).

ONGC Offers NELP Block Farm-Ins(Back to Top)

ONGC is India's largest producer of crude oil, natural gas, and LPG. Since its inception 44 years ago, it has made four basin discoveries and now produces from 108 fields in six sedimentary basins. It is active in 16 of the 26 sedimentary basins.

In May, ONGC shifted a rig from Kerala-Konkan to the Krishna-Godavari Basin for a deepwater well. It said it would be installing a platform in the G-22 Block offshore Godavari to start production.

The company plans to hold talks with several international oil companies on E&P activities in the six deepwater blocks it was awarded in April. According to the Indian Financial Express newspaper, negotiations may take place with Marathon, Occidental, Royal Dutch/Shell, Unocal, ExxonMobil, Petrobas, and TotalFinaElf.

TotalFina, while not a bidder on the NELP blocks, has indicated an interest in purchasing stakes in the blocks operated by the Indian state-owned firms, particularly in the Bombay High area.

Cairn NELP Block Awarded Near Existing Blocks(Back to Top)

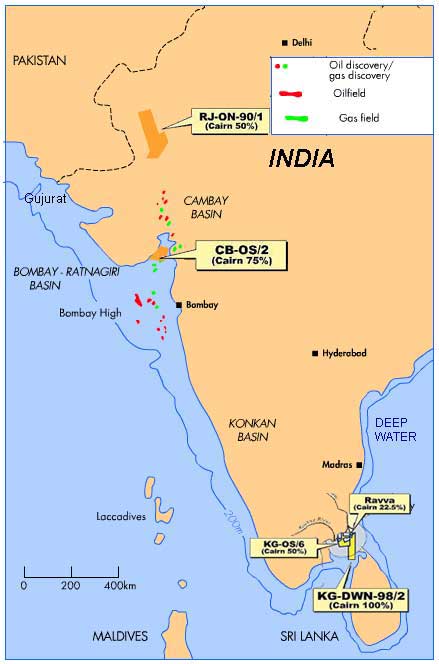

Edinburgh, UK-based Cairn Energy PLC, through its wholly owned subsidiary Cairn Energy India (CEI) was awarded deepwater block KG-DWN-98/2, offshore eastern India in the Krishna-Godavari Basin. The award of the block augments its existing exploration and production interests in the basin and brings to four its exploration license count. The block (CEI 100% interest) covers an area of approximately 9,800 km² and is situated less than 10 km to the south of the 250 million bbl Ravva oil and gas field. It is also adjacent to block KG-OS/6 (Cairn 50%), the only deepwater acreage operated by a foreign oil company in India, in which it plans an exploration well later this year.

Dr. Michael Watts, Cairn's exploration director, described the block as, "...one of the most sought-after in the licensing round, due to the presence of a proven hydrocarbon system."

A 3D seismic program by PGS commenced in May in the northern third of the block to define drilling targets for the first phase of the exploration program under the Production Sharing Contract (PSC). 2D seismic data will also be acquired in areas of deeper water on the block to delineate possible medium- to long-term exploration targets.

"We are keen to get after this," said Malcolm Thomas, Cairn's general manager, "We have 100% of the block, so there is no waiting around for budget years or partner approvals."

Cairn — First New Foreigner Discoveries(Back to Top)

The first discoveries made in India by a foreign company since the commencement of licensing rounds were made by Cairn, together with its co-venturer Shell India Production Development BV, in late 1999 and early 2000. During tests, the exploration well Guda-2 (RJ-ON-90/1, Rajasthan) flowed oil to the surface on a restricted choke at a stabilized rate of 2,000 b/d oil with no water. Further drilling is anticipated to commence in late 2000.

Then in May, on the shallow water offshore block CB-OS/2 it operates in the Gulf of Cambay, offshore Gujurat, western India, only three months after acquiring seismic, Cairn drilled exploration well CB-A-1, which lead to a gas discovery encountering multiple pay zones. On test, a total of 30 meters gross interval was perforated and flowed at a stabilized rate of 28.1 million cf/d gas on a 56/64" choke at a flowing well head pressure of 734 psi. The gas is dry methane with no CO2 or H2S. Cairn said it estimated mean reserve for the structure is 400 Bcf. The company said it intends to drill exploration wells on a number of further prospects that have been identified on the block. Including the existing discovery, these are said to have a combined unrisked mean reserve expectation of 2 Tcf.

Cairn — 2000 E&P(Back to Top)

In addition to the seismic over the NELP block, around 300 sq km of 3D seismic was to have been acquired in the first quarter of 2000 over two of it's permits, KG-OS/6 and Ravva, while CB-OS/2 was to have 2500 km of 2D during the same period. Production from its Ravva facility continues to supply 8% of India's total oil production with 50,000 b/d oil.

Problems with Politics(Back to Top)

While a few foreign companies do well in the region, others believe politics to be a major problem. In neighboring Bangladesh, protracted negotiations over onshore block nine were delayed when Texaco refused to sign the PSC in its original form. It's reluctance to sign hinged largely on the matter of gas exports to India, a highly political issue in Bangladesh, but one seen by many western oil companies as key to the commercial viability of investments.

Timeliness of Indian Government processes is another major detraction to explorers. Previous licensing rounds have been mired in bureaucracy, with PSC negotiations taking years to resolve, however the 2000 awards of NELP blocks were done in a record four and half months, and all 22 PSCs for the blocks were signed in April, within three months of the acreage being awarded.

Paul Fieldsend, regional analyst with oil and gas consultancy Wood Mackenzie, said, "Past delays have put people off investing in India. This is a huge improvement on any of the past licensing rounds...It sends a very positive signal that they are serious about getting things moving."

2000 also marked the end of a frustrating wait for development permission on six oil fields in Gujarat state, western India. After sitting on a proposal for the past three years, it took the personal intervention of the state chief minister Keshubhai Patel, to get the Ministry for Petroleum & Natural Gas to finally give the go-ahead to the Gujarat State Petroleum Corp for the development. Patel, it is understood, had to call upon petroleum minister Ram Naik to get this done.

Political instability, with three governments in as many years, has caused an erratic progress of reform in India. The current BJP government is driven in no small part by swadeshi, or self-reliance, however many believe it has overcome its xenophobic tendencies to pursue the foreign investment and technology required for E&P of oil and gas resources.

Despite all this, the country has had three years of more than 5% growth and is on a purchasing power parity basis. The World Bank predicts that by 2020, India will be the fourth largest economy in the world—its population recently passed 1 billion.

Nothing can obscure the significance of numbers like these, and as a market its potential cannot be overlooked. Any gas discovery is, as Bill Gammell, Cairn's chief executive pointed out, "...close to one of the world's fastest growing quality gas markets."